The Rise of Cryptocurrency Trading: A New Era of Market Movement

The world of cryptocurrency trading has seen a significant increase in popularity in recent years. With the advent of blockchain technology and its ability to facilitate peer-to-peer transactions, cryptocurrencies like Bitcoin, Ethereum, and others have become increasingly attractive to investors and traders alike.

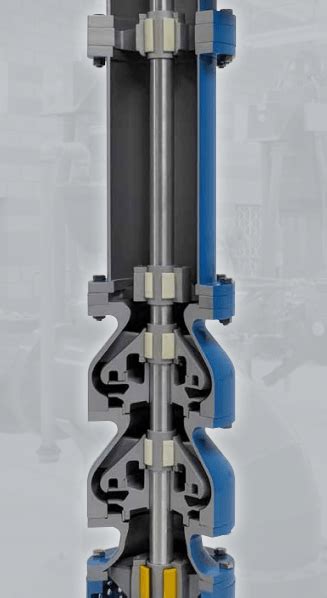

Pump and Pull art

One of the most popular cryptocurrency trading strategies is known as “pump and pull.” This involves a buying spree, artificially inflating the price of an asset on social media platforms like Twitter, Reddit, or other online forums. The resulting surge in demand could lead to a massive sell-off, causing prices to plummet.

On the other hand, some traders take advantage of this phenomenon to make quick profits by selling at the peak and waiting for the price to drop further. This is called a “take profit” trade. By selling at the peak, traders are essentially locking in their profits against a potential decline in value.

Take Profit: The Basic Strategy

Taking profit is a key aspect of cryptocurrency trading that allows traders to make money on their investments while minimizing losses. This is an extremely important strategy for those who have made large profits and want to preserve their wealth.

To take profit, traders typically set a target price and wait for it to reach that level before closing their positions. This can be done using various stop-loss orders or simply by selling at the desired price. This allows traders to ensure that they do not miss out on additional profits while protecting their capital.

Multi-platform Trading: A Growing Trend

The popularity of cross-platform trading has skyrocketed in recent years. This means the ability for investors and traders to access and execute trades on a variety of platforms, including traditional exchanges like Binance or Coinbase, as well as online brokers and trading apps.

Multi-platform trading offers traders many benefits, such as reduced transaction fees, better liquidity, and greater market accessibility. By allowing traders to trade on multiple platforms, cross-platform trading has become easier than ever before.

Benefits of Cross-Platform Trading

The growth of cross-platform trading has brought several benefits to investors and traders:

- Reduced Transaction Fees: By connecting to multi-platform trading, users can take advantage of lower fees on multiple exchanges.

- Increased Liquidity: Multi-platform trading gives users the ability to trade a wider variety of assets, increasing the overall market size.

- Improved User Experience: With access to multiple platforms, traders can choose the one that best suits their needs and preferences.

Challenges and Risks

While cross-platform trading offers many benefits, it also comes with several challenges and risks:

- Increased Competition: Due to trading on different platforms, competition between exchanges and brokers has increased.

- Security Issues: As with any online transaction, traders must take the necessary precautions to ensure the security of their accounts and funds.

- Regulatory Uncertainty: Cross-platform trading raises regulatory issues, particularly with regard to Anti-Money Laundering (AML) and Know Your Customer (KYC) requirements.

Conclusion

The world of cryptocurrency trading has undergone major changes over the past year, with cross-platform trading being one of the main drivers of this growth. By understanding pump and pull strategies, taking profits, and utilizing cross-platform trading, traders can increase their chances of success in this rapidly evolving market.